unified estate tax credit 2019

Tax Credits LLC is located at 45 Knightsbridge Rd Piscataway NJ 08854. The includible property may consist of cash and securities real estate insurance trusts annuities business interests and other assets.

Charitable Deduction Rules For Trusts Estates And Lifetime Transfers

The amount of the credit allowable under subsection a shall be reduced by an amount equal to 20 percent of the aggregate.

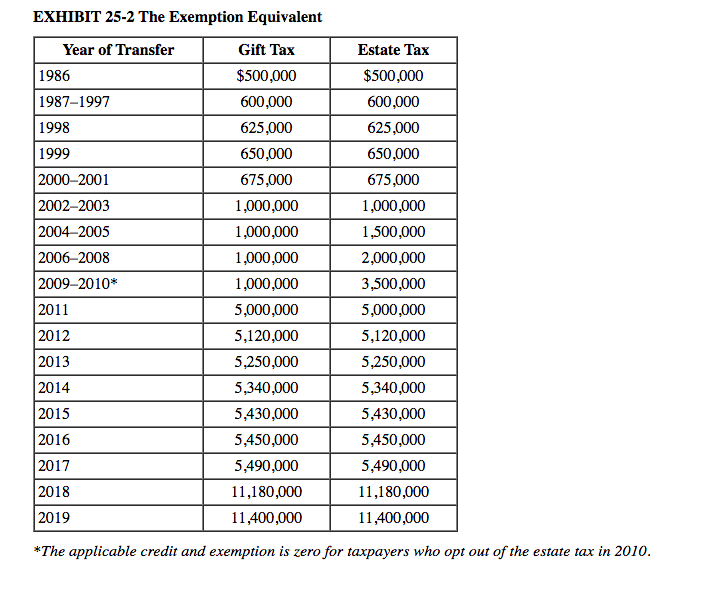

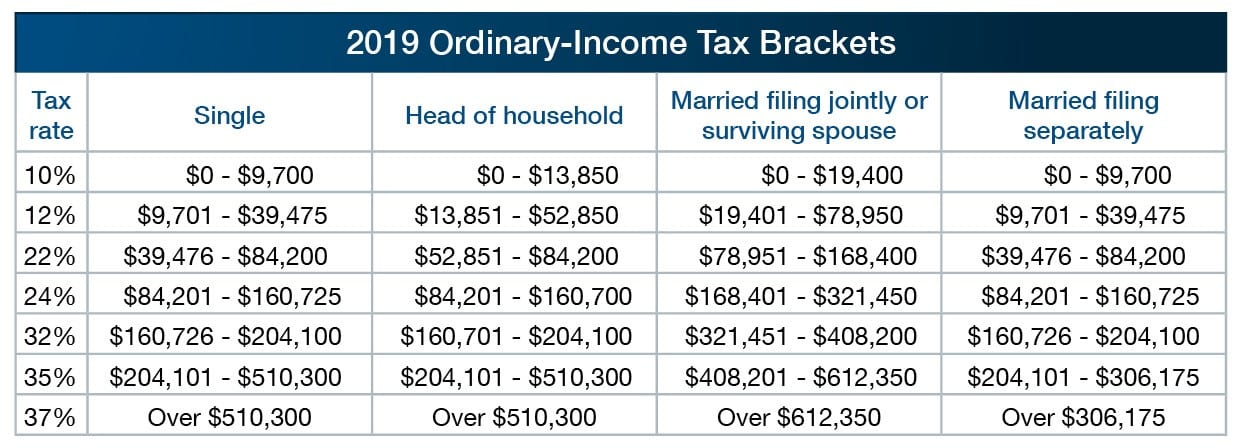

. Doing the math the 2019 unified credit is 4505800 up 88000 from 2018s levels. Once you have the lifetime exclusion amount you can figure out the amount of the unified credit by running it through the brackets. Up from 1118 million per individual in 2018 to 114 million.

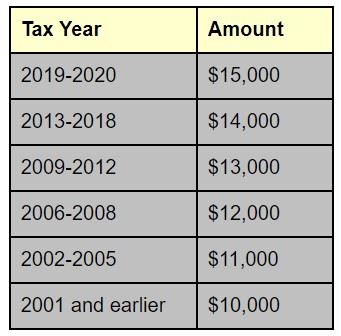

The tax reform law doubled the BEA for tax-years 2018 through 2025. A tax credit is different from a tax deduction Net Metering. Beginning in 2022 the annual gift exclusion will be 16000 per doner up from.

Tax credits are dollar-for-dollar reductions in the amount of income tax that you owe the federal government. A tax credit that is afforded to every man woman and child in america by the irs. Your gross income is more than 20000 10000 if filing status is single or marriedCU partner filing separate return or you and or your spousecivil union partner if.

Get Tax Credits LLC reviews ratings business hours phone. Because the BEA is adjusted annually for inflation the 2018 BEA is 1118 million the 2019 BEA is 114 million. But all of this is more complicated than it has to be from a taxpayers standpoint.

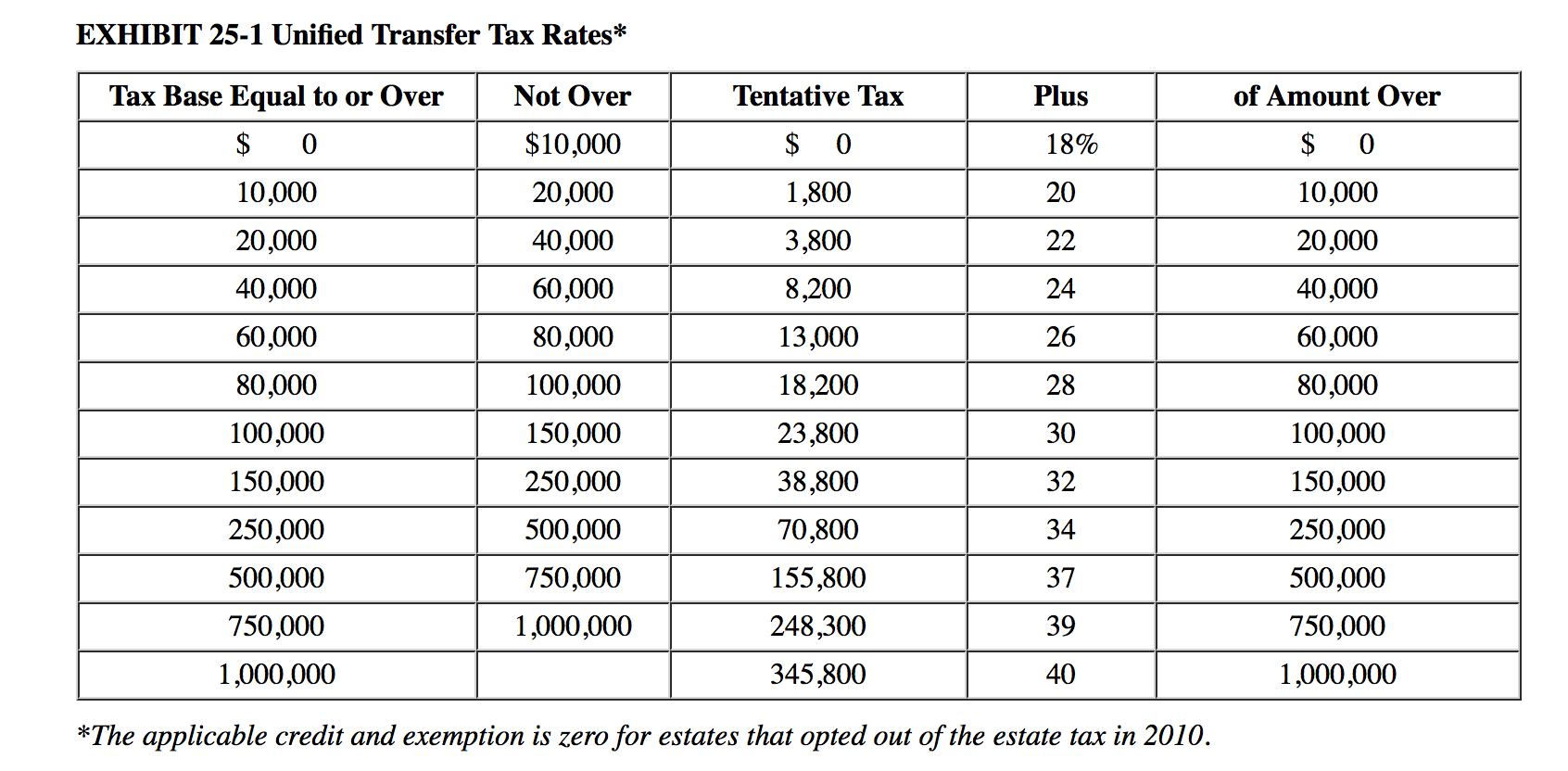

What is the unified tax credit for 2019. What is the unified tax credit for 2019. The applicable credit amount is commonly referred to as the Unified Credit because it is both unified ie it is a single amount that is applied to transfers otherwise.

But all of this is more complicated than it has to be from a taxpayers standpoint. Once you have accounted for the Gross Estate. Tax Credits LLC can be contacted at 732 885-2930.

If the committee review the buildings the tax assessor classifies as 4C apartment buildings they will be note those built before 1988 had taxes increased an average of 7 after the revaluation. The IRS has issued tax year 2019 inflation adjustments for more than 60 tax provisions including tax rate schedules. Unified Estate And Gift Tax Credit 2021.

If you were married your spouse also a us. Confused about the new tax provisions. If a tax on a gift has been paid under chapter 12 sec.

Doing the math the 2019 unified credit is 4505800 up 88000 from 2018s levels. The Internal Revenue Service IRS recently announced that the estate and gift tax exemption is increasing next year. B Adjustment to credit for certain gifts made before 1977.

Under the 2017 Tax Act the basic exclusion is increased from 5000000 to 10000000 for 2018 and the 10000000 is indexed for inflation occurring after 2011. Once you have the lifetime exclusion amount you can figure out the amount of the unified credit by running it through the brackets.

Msu Extension Montana State University

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Irs Estate Tax Appraisal Services Denver Worthwise Art And Antiques Appraisers

Solved Exhibit 25 1 Unified Transfer Tax Rates Plus Of Chegg Com

The Future Of The Unified Tax Credit And Potential Strategies Cba S Thebar

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

2020 2021 Unified Tax Credit And Lifetime Gift Tax Exclusion Parisi Coan Saccocio Pllc

The U S Gift And Estate Tax Htj Tax

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

How The Unified Tax Credit Maximizes Wealth Transfer Blog Jenkins Fenstermaker Pllc

A Taxing Matter For Family Businesses Mercer Capital

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver

Tackling Tax Issues If You Re An Estate Executor Ferrari Ottoboni Caputo Wunderling Llp

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

A Look At 2020 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

What Is The Unified Credit Doane And Doane P A

What Do 2019 Cost Of Living Adjustments Mean For You Pya

Solved Exhibit 25 1 Unified Transfer Tax Rates Not Over Chegg Com